Getting car insurance can seem daunting, but understanding what details are required can simplify the process. This guide will walk you through the essential information you need to gather before contacting an insurance provider, ensuring a smooth and efficient application.

Essential Information for Your Car Insurance Application

Several key details are required when applying for car insurance. Having these readily available will streamline the process and help you get the most accurate quote. These details are crucial for the insurer to assess risk and determine your premium.

- Personal Details: Your full name, address, date of birth, and driving license number are fundamental. These help verify your identity and driving history.

- Vehicle Information: This includes the make, model, year, and Vehicle Identification Number (VIN). The VIN is crucial as it provides a unique identifier for your car and its history.

- Usage Details: How you use your car significantly impacts your premium. Be prepared to tell them if it’s for commuting, personal use, or business purposes. Annual mileage estimates are also important.

- Driving History: Any past accidents, claims, or driving convictions will be relevant. Be honest and upfront about these as withholding information can invalidate your policy.

- Additional Drivers: If anyone else will be driving the car, their details will also be needed, including their driving history.

- Existing Coverage (if applicable): If you’re switching insurers, providing details of your current coverage can be helpful.

Understanding Why These Details Matter

Car Insurance Application Form Details

Car Insurance Application Form Details

Why do insurance companies ask for so much information? These details are not simply bureaucratic hurdles. They are essential for accurately assessing the risk you represent as a driver and the risk associated with your vehicle. This allows them to calculate a fair and appropriate premium. For example, a newer car with advanced safety features might qualify for a lower premium than an older model. Similarly, a driver with a clean driving record will generally pay less than someone with multiple accidents or convictions. Accurate information ensures you receive the right coverage at a competitive price.

where do i go to get my car detailed

Preparing Your Documents

Gathering the necessary documents beforehand can save you time and effort. This typically includes your driving license, vehicle registration document (V5C), and any previous insurance documents if applicable. Having these ready ensures a smooth application process.

What Details Do I Need to Insure a Car Online?

Online Car Insurance Application Process

Online Car Insurance Application Process

The online application process often mirrors the traditional one. You’ll need the same information detailed above, but the convenience of online platforms allows you to enter the details at your own pace and often compare quotes from different providers. Remember to double-check all information for accuracy before submitting your application.

how can i check my car details through sms

How Do Insurance Companies Use My Car Details?

Insurance companies use your car details to determine the value of your vehicle, the likelihood of theft, and the cost of repairs. This information, combined with your personal driving history, contributes to the overall risk assessment.

Finding the Right Insurance for You

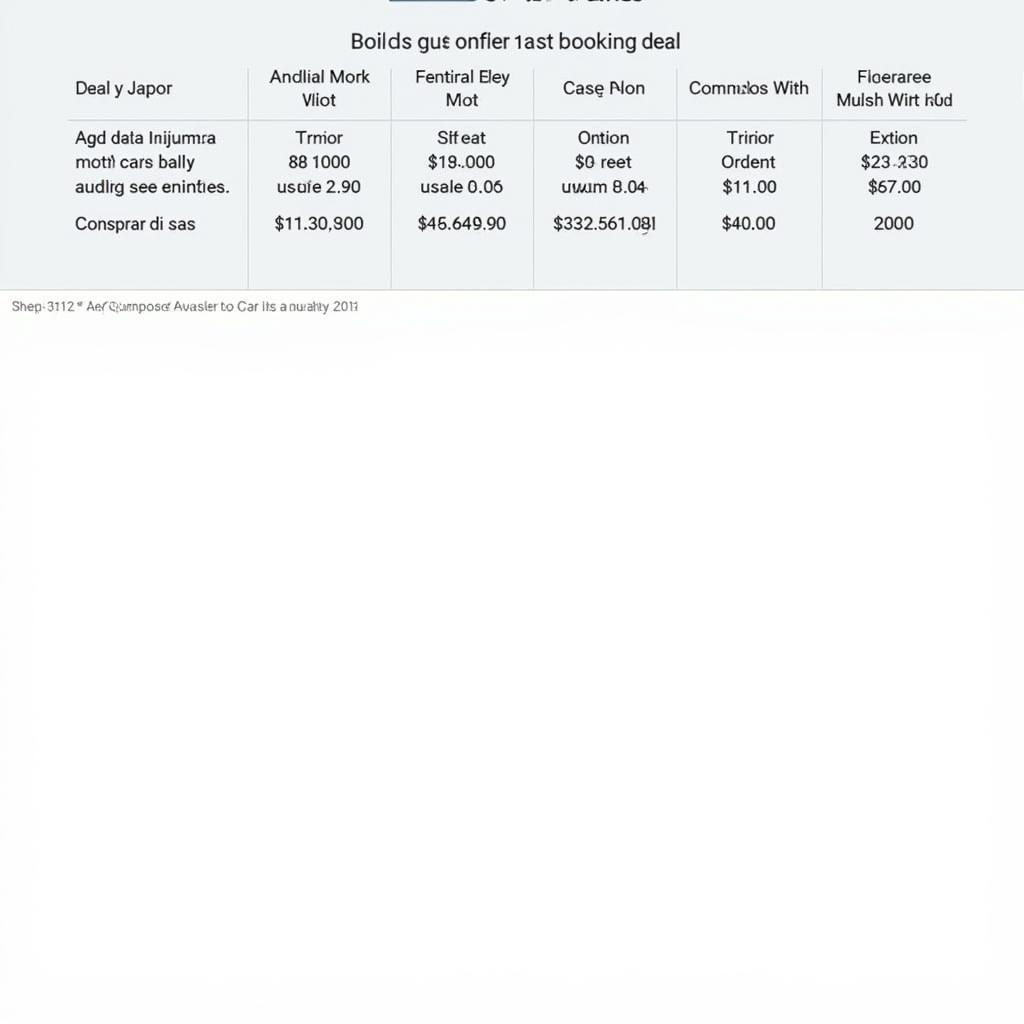

Comparing Car Insurance Quotes Online

Comparing Car Insurance Quotes Online

Once you have all the necessary details, comparing quotes from multiple insurers is crucial. This allows you to find the best balance of coverage and price. Don’t hesitate to ask questions and clarify any doubts you may have.

do you need a business license to detail cars

Conclusion

Knowing What Details Are Required For Car Insurance empowers you to navigate the process efficiently. By gathering the necessary information beforehand, you can ensure a smoother application experience and secure the right coverage for your needs. Remember to be accurate and honest with the information you provide.

FAQ

- What if I don’t have all the details immediately available? Contact the insurer and explain your situation. They may be able to guide you.

- Can I get insurance without a driving license? No, a valid driving license is essential for obtaining car insurance.

- Does my credit score affect my car insurance premium? In some regions, yes, your credit score can be a factor in determining your premium.

- What if my car is modified? Modifications can impact your premium, so declare them to your insurer.

- What is a No Claims Bonus (NCB)? NCB is a discount you earn for each year you don’t make a claim.

- Can I insure a car I don’t own? Generally, you need to have an insurable interest in the vehicle, meaning you would suffer a financial loss if it were damaged or stolen.

- What if I disagree with the information the insurer has about me? You have the right to dispute inaccurate information and provide supporting documentation.

Need help with car diagnostics or detailing? Contact us via WhatsApp: +1(641)206-8880 or Email: [email protected]. Our 24/7 customer service team is here to assist.

Leave a Reply