Hdfc Used Car Loan Details are crucial for anyone considering financing a pre-owned vehicle. This guide provides comprehensive information on interest rates, eligibility, loan amounts, and the application process, empowering you to make informed decisions.

Understanding HDFC Used Car Loan Details

When exploring HDFC used car loan details, you’ll find various factors influencing your loan terms. These include the age and model of the car, your credit score, and your income. Understanding these factors can help you secure the best possible loan.

Interest Rates and Loan Tenure

HDFC used car loan interest rates are competitive and vary based on several factors.  HDFC Used Car Loan Interest Rates Chart Longer loan tenures often come with lower EMIs but higher overall interest payments. Conversely, shorter tenures result in higher EMIs but lower total interest. Carefully consider your budget and choose the tenure that aligns with your financial goals.

HDFC Used Car Loan Interest Rates Chart Longer loan tenures often come with lower EMIs but higher overall interest payments. Conversely, shorter tenures result in higher EMIs but lower total interest. Carefully consider your budget and choose the tenure that aligns with your financial goals.

Eligibility Criteria and Required Documents

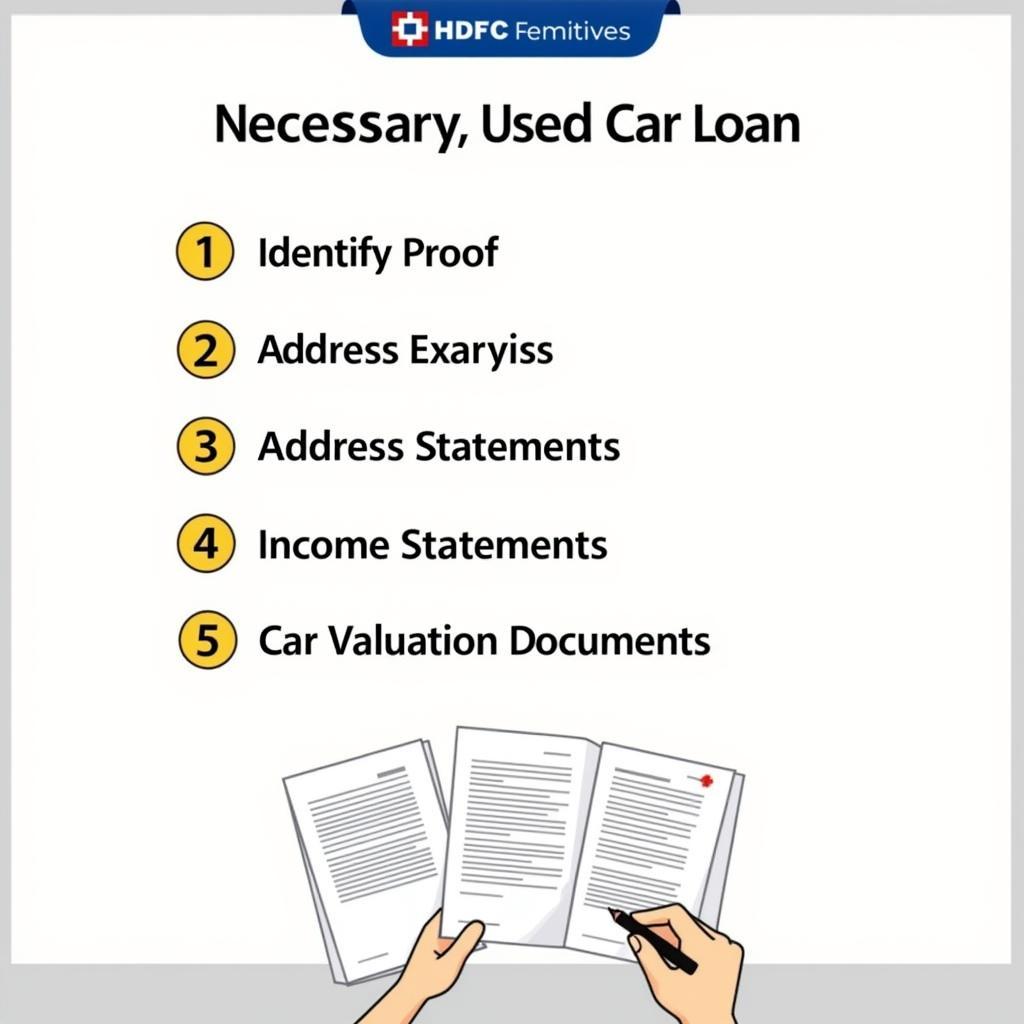

Meeting HDFC’s eligibility criteria is essential for loan approval. Generally, applicants must be Indian citizens or residents with a stable income and a good credit history.  Required Documents for HDFC Used Car Loan Be prepared to provide documents like identity proof, address proof, income statements, and car valuation documents.

Required Documents for HDFC Used Car Loan Be prepared to provide documents like identity proof, address proof, income statements, and car valuation documents.

HDFC Used Car Loan Application Process: A Step-by-Step Guide

Applying for an HDFC used car loan is straightforward. You can apply online through HDFC’s website or visit a branch. The process typically involves filling out an application form, submitting the required documents, and awaiting loan approval.

Calculating Your EMI and Loan Amount

Before applying, utilize HDFC’s online car loan EMI calculator to estimate your monthly payments. This tool helps you determine an affordable loan amount and tenure. Understanding your potential EMI helps you plan your finances effectively.

Tips for Securing the Best HDFC Used Car Loan

Negotiate the interest rate and loan terms with HDFC. A strong credit score can significantly improve your bargaining power. Also, consider making a larger down payment to reduce the loan amount and potentially secure a lower interest rate.  Tips for Getting the Best HDFC Used Car Loan

Tips for Getting the Best HDFC Used Car Loan

Conclusion

HDFC used car loan details offer flexible financing options for purchasing your dream pre-owned vehicle. By understanding the key details, eligibility requirements, and application process, you can navigate the loan process confidently and secure the best possible terms.

FAQ

- What is the maximum loan tenure for a used car loan from HDFC?

- Can I apply for a used car loan online?

- What is the minimum down payment required for a used car loan?

- Does HDFC finance cars older than a certain age?

- What factors affect the interest rate on a used car loan?

- How long does it take to get loan approval?

- Can I prepay my used car loan?

Need assistance with your car detailing needs? Contact us via WhatsApp: +1(641)206-8880, or Email: [email protected]. Our 24/7 customer service team is ready to help.

Leave a Reply