Do I Need Insurance Details To Tax My Car? This is a common question for UK drivers, especially with the shift towards online vehicle management. Understanding the relationship between car insurance, vehicle tax (VED), and the continuous insurance enforcement (CIE) is crucial for staying on the right side of the law and avoiding potential fines.

If you’re looking to tax your car in the UK, you might be wondering if you need your insurance details at hand. The short answer is yes, indirectly. While you won’t directly input your insurance policy number when taxing your vehicle online or at the post office, the DVLA (Driver and Vehicle Licensing Agency) will check your vehicle’s insurance status against their database. This is part of the Continuous Insurance Enforcement (CIE) scheme, which aims to reduce the number of uninsured drivers on UK roads. Having valid insurance is a prerequisite for taxing your car.

How Does Insurance Impact Car Taxing?

The CIE makes it an offence to keep a vehicle that’s not insured, even if it’s not being used on public roads. This means that before you can tax your car, you must have valid insurance in place. The DVLA automatically checks this against the Motor Insurance Database (MID).

If your vehicle is shown as uninsured on the MID, you won’t be able to tax it. You’ll need to ensure your insurance details are correctly recorded on the MID. If you believe there’s an error, you’ll need to contact your insurance provider to rectify it. How to check car insurance policy details by policy number.

Checking Car Tax and Insurance Status Online

Checking Car Tax and Insurance Status Online

What if I Just Bought the Car?

When you buy a new or used car, you’re legally required to insure it before driving it on the road. Even if you’re driving it straight home from the dealership, insurance is mandatory. This also applies when taxing the vehicle. Ensure you have insurance in place before attempting to tax the car, as the DVLA’s system will flag any uninsured vehicles.

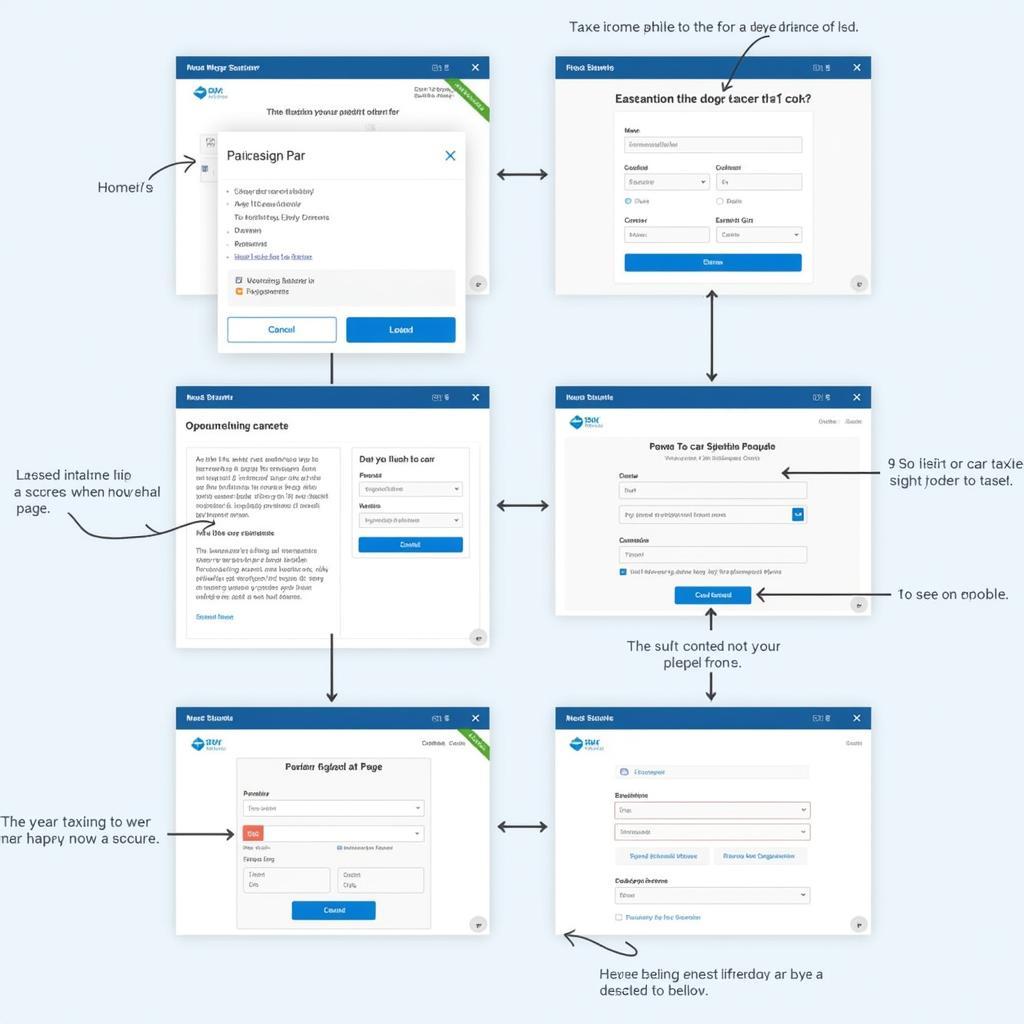

Taxing Your Car: A Step-by-Step Guide

The process of taxing your car is fairly straightforward, regardless of whether you do it online, at the post office, or by phone. You’ll need your vehicle’s registration document (V5C), sometimes referred to as the logbook. While you don’t need your insurance details directly, remember that the DVLA independently verifies your insurance status.

- Gather your documents: Have your V5C ready.

- Go online, to the post office, or call: Choose your preferred method for taxing your vehicle.

- Provide your details: You’ll need to enter your vehicle’s registration number.

- Pay the tax: The amount you pay depends on your vehicle’s emissions and fuel type.

- Receive confirmation: You’ll receive a confirmation of your car tax payment.

Taxing Your Car Online: A Step-by-Step Process

Taxing Your Car Online: A Step-by-Step Process

Do I Need a Driving Licence to Tax My Car?

While not directly needed for the taxing process, ensuring your driving licence details are up-to-date is important. Do you need license to do mobile detail cars. Having accurate information linked to your vehicle ensures a smooth process for all vehicle-related administrative tasks.

Ensuring Your Insurance Details are Correct

To avoid any issues when taxing your car, it’s essential to confirm that your insurance details are correctly recorded on the MID. You can check this online by visiting the AskMID website. This allows you to confirm that your vehicle is insured and that the details held are accurate. How to check my car details online.

“Regularly checking your car’s insurance status on the MID is a simple yet crucial step for all car owners,” advises John Smith, Senior Motoring Advisor at the AA. “It can prevent unnecessary complications and potential fines.”

What Happens if My Car is Uninsured?

Driving without insurance is a serious offence in the UK. You could face a fixed penalty, court prosecution, and even have your vehicle seized. It’s also essential to understand how to access your registration details. How do i know my car registration details. Furthermore, How to check car registration details is important for various car-related tasks.

“Ensuring continuous insurance coverage not only protects you in case of an accident but also helps you avoid legal trouble and penalties,” says Jane Doe, Head of Claims at a major insurance company.

Conclusion

Do you need insurance details to tax your car? Not directly, but having valid insurance is a non-negotiable requirement. The DVLA checks your insurance status before allowing you to tax your vehicle as part of the CIE. Ensuring your car is insured and that your details are correctly recorded on the MID is crucial to avoid any complications during the taxing process. Remember to check your vehicle’s insurance status regularly and update your details if necessary for a seamless and hassle-free experience.

FAQ

- What is VED? VED stands for Vehicle Excise Duty, commonly known as car tax.

- How often do I need to tax my car? Typically, car tax is paid every 6 or 12 months.

- What happens if I don’t tax my car? You could face a fine and even have your vehicle clamped.

- Can I tax my car without a V5C? It’s more complicated but possible; contact the DVLA.

- How can I check my car’s tax status? You can check online via the government website.

- What is SORN? SORN stands for Statutory Off Road Notification, used when you’re not using your car on public roads and don’t want to tax it.

- How can I update my insurance details on the MID? Contact your insurance provider.

Need further assistance? Contact us via WhatsApp: +1(641)206-8880, or Email: [email protected]. Our customer support team is available 24/7.

Leave a Reply