As a car detailing business owner, understanding your tax obligations is crucial. One of the most common questions is, Can You Charge Taxes For Car Detailing? The short answer is: most likely, yes. This article will delve into the specifics of sales tax for car detailing services, helping you navigate the complexities and ensure you’re compliant with the law.

Do you need to collect sales tax for your car detailing services? The answer depends largely on where your business operates. Most states in the US require businesses that provide taxable services, including car detailing, to collect sales tax from customers. This collected tax is then remitted to the state’s revenue department. Ignoring these regulations can result in penalties, interest charges, and even legal action. Knowing the rules is essential for running a successful and legal car detailing operation.

Understanding Sales Tax for Car Detailing

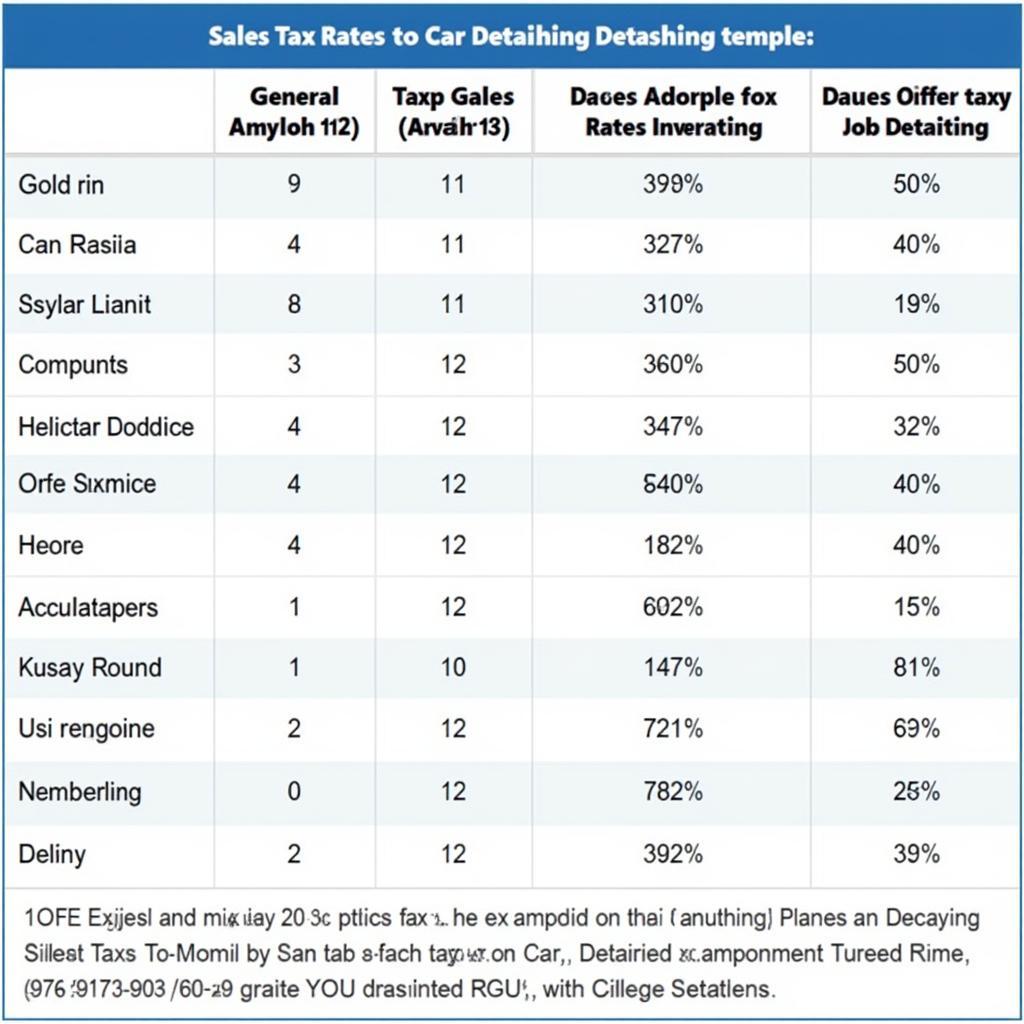

Sales tax for car detailing falls under the broader category of sales tax for services. While some states primarily tax the sale of goods, many also extend this to various services, including automotive repair and maintenance, of which car detailing is often considered a part. The specific regulations vary significantly by state, making it crucial to research your local laws. Some states have exemptions for certain services or offer different tax rates depending on the service provided.

After the introduction paragraph, here’s a link to another helpful article: how to open a car detailing business in nevada.

Determining Your Tax Obligations

How do you figure out what you owe? The first step is to determine if your state considers car detailing a taxable service. The best way to do this is to contact your state’s department of revenue or consult with a tax professional. They can provide definitive answers specific to your location and business structure. Once you’ve established whether you need to collect sales tax, you’ll need to register for a sales tax permit. This permit allows you to legally collect sales tax and remit it to the state. Failure to register can lead to significant fines.

Car Detailing Tax Calculator

Car Detailing Tax Calculator

Calculating and Collecting Sales Tax

Calculating the correct amount of sales tax can be complicated, especially if your state has variable rates. Generally, you’ll apply the appropriate sales tax percentage to the total cost of the detailing service. Most point-of-sale systems can automatically calculate and add sales tax to invoices, simplifying the process. Accurate record-keeping is vital for staying organized and prepared for tax season. Maintaining detailed records of sales, taxes collected, and remitted amounts is essential for accurate reporting and avoiding potential issues during audits.

Penalties for Non-Compliance

Failing to collect and remit sales tax can have serious consequences. Penalties can include back taxes, interest charges, and substantial fines. In some cases, repeated non-compliance can even lead to criminal charges. Understanding and adhering to your state’s sales tax regulations is crucial for protecting your business from these potential repercussions.

State Sales Tax Rates for Car Detailing

State Sales Tax Rates for Car Detailing

Staying Informed and Up-to-Date

Tax laws and regulations can change, so staying informed is critical. Subscribing to updates from your state’s department of revenue can help you stay abreast of any changes that might affect your business. Consulting with a tax advisor regularly can also provide valuable insights and ensure you’re always in compliance.

“Staying informed about tax regulations is not just a good idea, it’s essential for the long-term success of your car detailing business,” says John Smith, CPA at Automotive Accounting Solutions.

Conclusion

Can you charge taxes for car detailing? In most cases, yes. Understanding and complying with sales tax regulations is a vital aspect of running a successful and legal car detailing business. By staying informed, maintaining accurate records, and seeking professional advice when needed, you can navigate the complexities of sales tax and focus on growing your business. Don’t neglect this important aspect of your business operations.

Is it necessary to be licensed? Find out more in this article: do i.need to be licensed to detail a car.

Car Detailing Business Paying Taxes

Car Detailing Business Paying Taxes

FAQ

- Do all states require sales tax on car detailing? No, some states exempt certain services.

- How do I register for a sales tax permit? Contact your state’s department of revenue.

- What are the penalties for not collecting sales tax? Penalties can include back taxes, interest, and fines.

- How often do I need to remit sales tax? This varies by state, typically monthly or quarterly.

- Where can I find information specific to my state? Contact your state’s department of revenue.

- Can I include sales tax in my pricing? Yes, you can incorporate sales tax into your advertised prices.

- What records should I keep? Maintain records of sales, taxes collected, and remittances.

Common Scenarios

- Mobile Detailing: Even mobile detailers typically need to collect sales tax.

- Detailing Packages: Sales tax applies to the total cost of the package.

- Tips: Tips are generally not subject to sales tax.

Related Articles and Questions

- How to price your car detailing services competitively?

- What are the legal requirements for operating a car detailing business?

- What insurance do I need for my car detailing business?

Need support? Contact us via WhatsApp: +1(641)206-8880, Email: [email protected]. Our customer support team is available 24/7.

Leave a Reply