Understanding bookkeeping is crucial for the success of any car detail business in Illinois. Effective bookkeeping practices not only ensure financial health but also compliance with state regulations. This article will provide practical bookkeeping examples and explain their importance for car detail businesses operating in Illinois.

Key Bookkeeping Concepts for Illinois Car Detailers

Accurate bookkeeping allows you to track income and expenses, manage cash flow, and make informed business decisions. It’s also essential for tax preparation and demonstrating financial stability to potential investors or lenders. In Illinois, maintaining proper records also helps ensure compliance with state sales tax regulations.

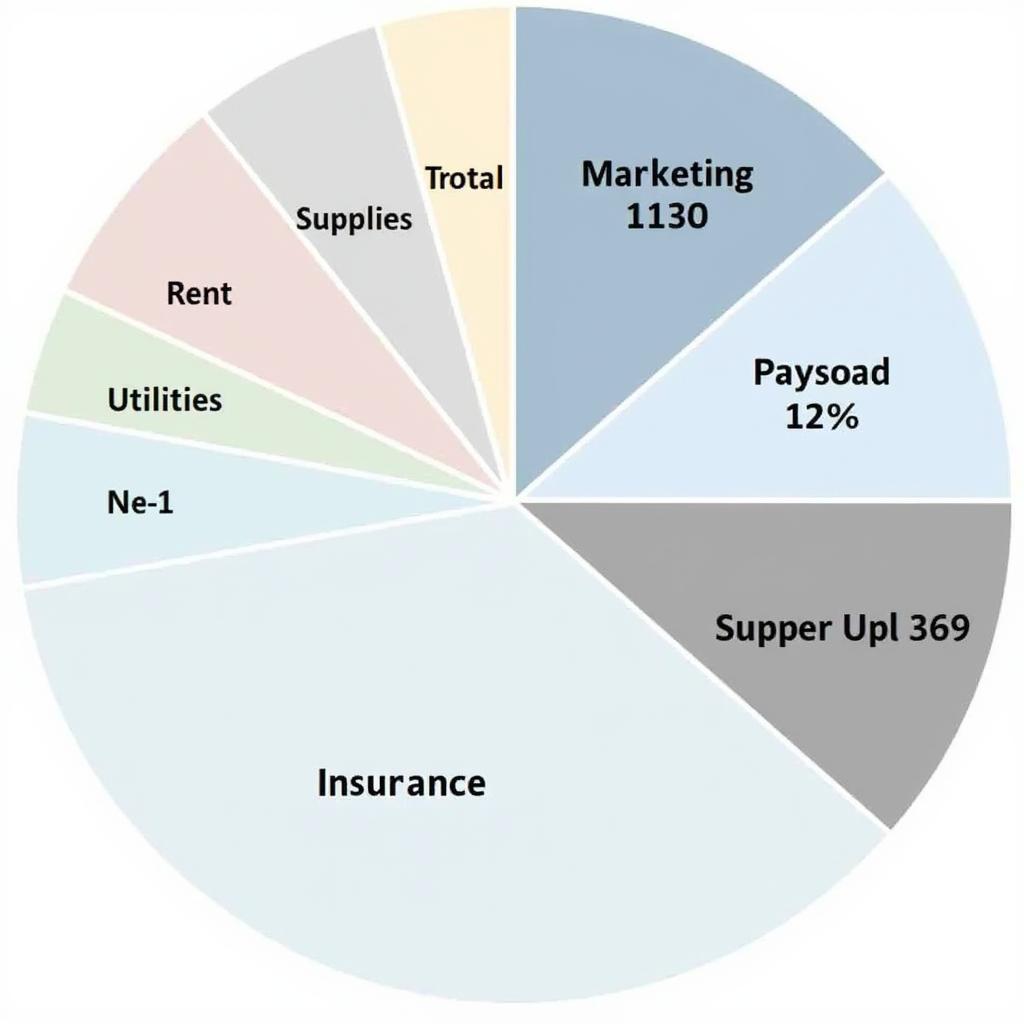

Income Tracking for Car Detailing in Illinois

Tracking income accurately is the cornerstone of good bookkeeping. For car detail businesses in Illinois, this includes meticulous recording of all revenue streams.

- Detailing Services: Record each service provided, the price charged, and the payment method.

- Product Sales: If you sell car care products, track each sale, including the product name, quantity sold, and price.

- Packages and Promotions: Maintain separate records for any special packages or promotional offers, noting the discounted price and any included services.

![]() Illinois Car Detail Income Tracking Spreadsheet

Illinois Car Detail Income Tracking Spreadsheet

Expense Management for Illinois Car Detailers

Managing expenses effectively is equally crucial for profitability. Categorize all expenses accurately to gain a clear understanding of where your money is going.

- Supplies: This includes detailing products, towels, applicators, and other consumables.

- Rent and Utilities: Track your rent or mortgage payments, as well as utilities such as water and electricity.

- Marketing and Advertising: Record costs associated with advertising, promotions, and website maintenance.

- Payroll: If you have employees, accurately record wages, taxes, and benefits.

- Insurance: Keep records of your business insurance premiums, including liability and property coverage.

Categorized Expenses for an Illinois Car Detail Business

Categorized Expenses for an Illinois Car Detail Business

Illinois Sales Tax for Car Detailers

In Illinois, car detailing services are generally subject to sales tax. Understanding and accurately applying sales tax is essential for legal compliance. Keep detailed records of all sales transactions, the amount of sales tax collected, and the date of each transaction. Consult with a tax professional to ensure you are collecting and remitting the correct amount of sales tax based on the current rates and regulations.

“Accurate sales tax record-keeping is not just a legal requirement; it’s a sign of a well-managed business,” says Sarah Miller, CPA, specializing in small business accounting in Illinois. “It simplifies tax filing and protects you from potential audits.”

Software and Tools for Bookkeeping

Various software and tools can simplify bookkeeping for your car detail business. Cloud-based accounting software allows you to access your financial data from anywhere and often integrates with other business tools.

- Accounting Software: Consider using software like QuickBooks or Xero, designed for small businesses.

- Spreadsheet Software: Even simple spreadsheet programs like Excel or Google Sheets can be effective for basic bookkeeping.

Bookkeeping Software Interface for Car Detailers

Bookkeeping Software Interface for Car Detailers

Conclusion

Implementing sound bookkeeping practices is essential for the success of your car detail business in Illinois. By diligently tracking income and expenses, managing sales tax accurately, and utilizing appropriate software, you can gain control of your finances, make informed decisions, and ensure long-term profitability. Remember, bookkeeping examples for car detail businesses in Illinois are readily available online and through professional resources. Taking the time to understand and implement these practices is an investment in the future of your business.

FAQ

- What are the basic bookkeeping requirements for a car detail business in Illinois?

- What software can I use for bookkeeping for my car detail business?

- How do I track sales tax for my car detailing services in Illinois?

- What are the common bookkeeping mistakes car detailers make?

- Where can I find more information about bookkeeping regulations in Illinois?

- How often should I review my bookkeeping records?

- Can I hire a bookkeeper for my car detail business?

Need Help?

For assistance with car diagnostics and related services, please contact us via WhatsApp: +1(641)206-8880 or email: [email protected]. Our customer support team is available 24/7.

Leave a Reply