Changing your direct debit details for your car tax is a straightforward process. Whether you’ve switched banks, updated your card details, or simply need to amend your payment information, this guide will walk you through the necessary steps to ensure your vehicle tax payments continue without interruption.

Updating your direct debit information is crucial to avoid penalties and ensure your vehicle remains legally taxed. It’s much simpler than you might think, and you can typically manage the entire process online in just a few minutes. This article will cover everything you need to know, from the specific details required to practical tips for a smooth transition. what details are needed to tax a car

Why Might You Need to Change Your Direct Debit Details?

There are several reasons why you might need to update your direct debit information for your car tax:

- Change of Bank Account: If you’ve recently switched banks, you’ll need to update your direct debit details to reflect your new account information.

- Updated Card Details: If your debit card has expired or been replaced, you’ll need to provide the new card details for your direct debit.

- Change of Address: While not directly related to the direct debit itself, a change of address may require you to update your vehicle information, which could, in turn, prompt a review of your payment details.

- Cancellation of Direct Debit: If you previously cancelled your direct debit and now wish to reinstate it, you will need to set up a new direct debit with your current bank or card details.

How to Change Your Direct Debit Information Online

Changing your direct debit details for car tax online is a simple and efficient process:

- Access the DVLA Website: Visit the official Driver and Vehicle Licensing Agency (DVLA) website for vehicle tax services.

- Log In: You’ll need to log in using your vehicle registration number (number plate) and the 11-digit reference number found on your vehicle log book (V5C).

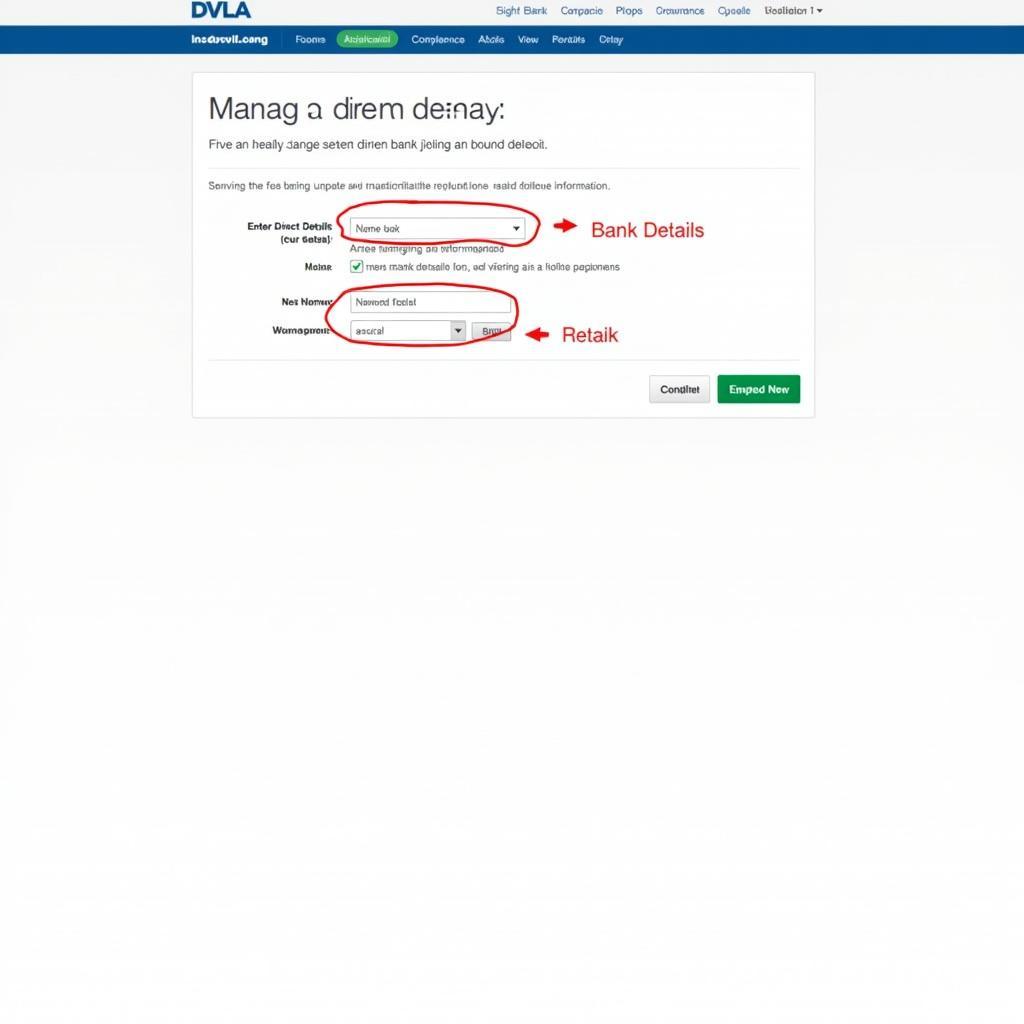

- Navigate to Direct Debit Section: Once logged in, locate the section for managing your direct debit.

- Enter New Details: Carefully input your new bank or card details, ensuring accuracy to avoid any payment issues.

- Confirm Changes: Review the information you’ve entered and confirm the changes to your direct debit.

- Confirmation: You should receive confirmation of the updated direct debit details, either on-screen or via email.

Changing Direct Debit Details Online

Changing Direct Debit Details Online

What if I Don’t Have My V5C Log Book?

If you’ve misplaced your V5C log book, you can still change your direct debit details. Contact the DVLA directly by phone or apply for a replacement V5C document online. They will guide you through the process of updating your direct debit information without the physical log book.

Can I Change My Direct Debit Details Over the Phone?

Yes, you can change your direct debit details over the phone by calling the DVLA. Have your vehicle registration number and any relevant payment information readily available.

How to Check Your Direct Debit Details

You can check your current direct debit details by logging into the DVLA website and navigating to the section for managing your vehicle tax. Your current payment information should be displayed. You can also find this information on your car tax reminder or renewal notice. how to check hdfc car loan details online

Tips for a Smooth Transition

- Double-check your details: Always double-check the accuracy of the new information you’ve entered.

- Keep a record: Keep a record of the changes you’ve made and any confirmation received.

- Contact the DVLA: If you encounter any issues or have questions, don’t hesitate to contact the DVLA directly.

“Regularly reviewing and updating your vehicle information, including your direct debit details, is a simple yet crucial step in responsible car ownership,” says John Smith, Senior Automotive Advisor at the National Motorists Association.

Conclusion

Changing your direct debit details for car tax is a quick and easy process that can be completed online or over the phone. Ensuring your payment information is up-to-date is essential to avoid penalties and keep your vehicle legally taxed.

FAQ

- What if I don’t have access to the internet? You can contact the DVLA by phone to update your details.

- How long does it take for the changes to take effect? Changes usually take effect within a few working days.

- What happens if my payment fails? The DVLA will attempt to take the payment again. If it fails again, you may face penalties.

- Can I change my payment frequency? Yes, you can change your payment frequency to monthly, six-monthly, or annually.

- What if I sell my car? You’ll need to notify the DVLA of the sale, and any future payments will be stopped.

- Can I pay my car tax by other methods? Yes, you can pay by debit or credit card, or at a Post Office.

- Where can I find more information about car tax? Visit the DVLA website for comprehensive information about vehicle tax.

“Staying informed about your car tax obligations and ensuring your payment details are accurate helps avoid unnecessary stress and potential fines,” advises Jane Doe, Lead Vehicle Tax Specialist at the DVLA.

Need further assistance? Please feel free to explore other relevant articles on our website. For personalized support, contact us via WhatsApp: +1(641)206-8880, or Email: [email protected]. Our dedicated customer support team is available 24/7 to address your queries.

Leave a Reply