Taxing your car online is a quick and convenient process, but you’ll need specific details to complete it. This guide provides a comprehensive overview of the information required, ensuring a seamless tax renewal experience.

Understanding the required details beforehand saves you time and frustration. Whether you’re a seasoned car owner or a first-timer, this article covers everything you need to know about taxing your car online. You can also find helpful resources on getting your car detailing license on our site.

Essential Documents and Information for Online Car Tax

To successfully tax your car online, gather the following information:

- Vehicle Registration Number (VRN): This is also known as your number plate.

- Make and Model of Your Car: This helps confirm the vehicle details.

- Reference Number from Your V5C Logbook (or V11 Reminder): The V5C, also known as the logbook, is a crucial document proving car ownership. The V11 is a reminder sent by the DVLA. Either document provides a unique reference number required for online tax renewal.

- Insurance Details: Valid insurance is a legal requirement for taxing your car. You’ll need your insurance policy number and details of your insurance provider.

- MOT Certificate (if applicable): If your car requires an MOT, a valid certificate is necessary for taxation.

- Payment Details: You’ll need a debit or credit card to pay the car tax online.

Having these details readily available will streamline the online process. Knowing how to find car details from registration number can be helpful when gathering this information.

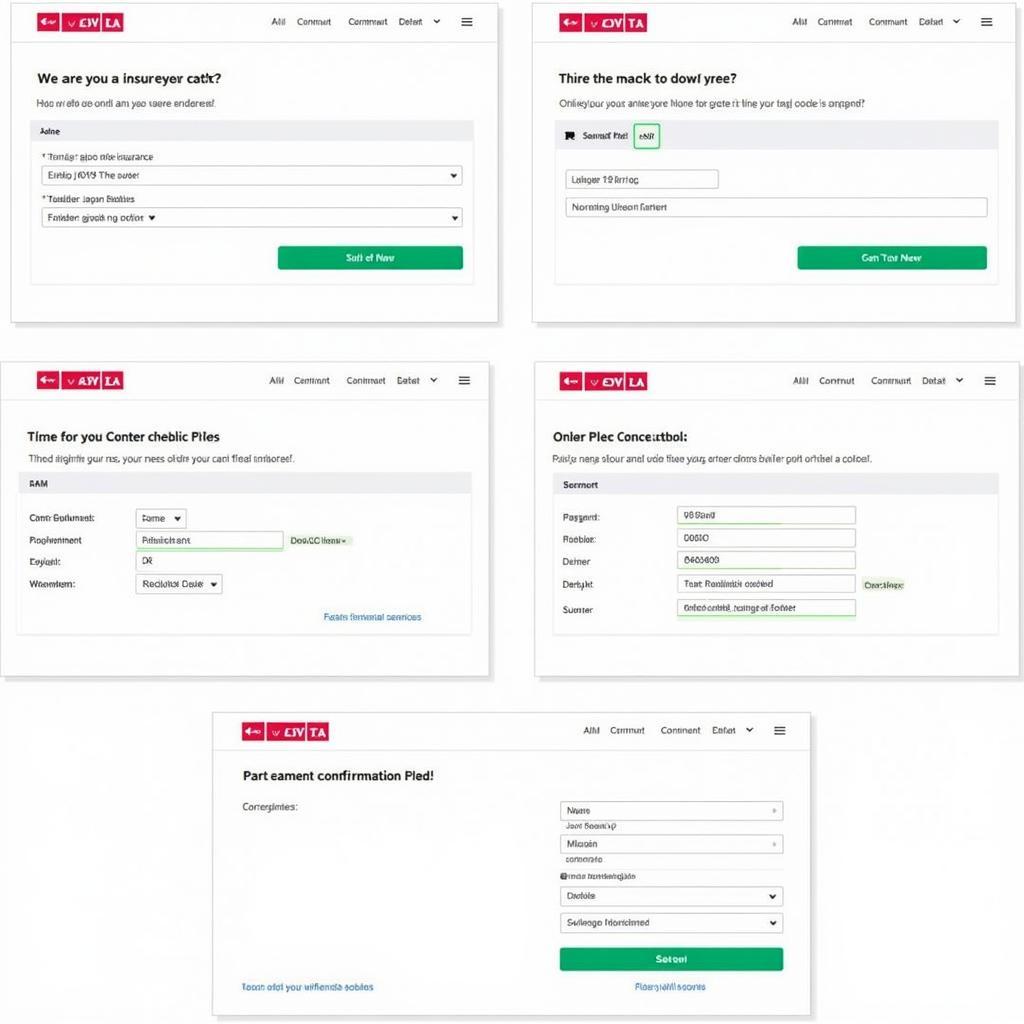

Step-by-Step Guide to Taxing Your Car Online

The online car tax process is straightforward. Here’s a step-by-step guide:

- Visit the DVLA Website: Navigate to the official government website for vehicle taxation.

- Enter Your Details: Input your VRN and the reference number from your V5C logbook or V11 reminder.

- Confirm Vehicle Details: Verify the information displayed about your car, such as make, model, and engine size.

- Provide Insurance Details: Enter your insurance policy number and the name of your insurer.

- Declare MOT Status: Confirm whether your car has a valid MOT certificate.

- Make Payment: Enter your payment details and proceed with the transaction.

- Confirmation: Once payment is successful, you’ll receive confirmation of your car tax renewal.

What if I Don’t Have My V5C Logbook?

Losing your V5C logbook can be stressful, but it’s possible to tax your car online even without it. You’ll need to apply for a new V5C and provide additional identification information during the online tax process. You may find our article on what is my car details helpful in this situation.

Step-by-step Online Car Tax Process

Step-by-step Online Car Tax Process

Do I Need to Tax My Car if It’s SORN?

If your car is declared SORN (Statutory Off Road Notification), you don’t need to tax it. However, before returning your car to the road, you’ll need to tax it again. Curious about updating your registration? Check out our guide on can you change car registration details online.

Expert Insights on Online Car Tax

“Taxing your car online is the most efficient method,” says John Smith, Senior Automotive Advisor at the National Motorists Association. “Having all the necessary documents ready beforehand makes the process seamless.”

Jane Doe, a vehicle registration expert, adds, “Remember, driving without valid car tax can lead to penalties, so ensure your tax is always up-to-date.”

Conclusion

Taxing your car online is a simple process when you have the correct details at hand. By following the guidelines in this article, you can easily renew your car tax and avoid any potential complications. Remember to always keep your car tax up-to-date to stay on the right side of the law. For further information about vehicle owner details, you can also refer to our guide on how to get details of a person by car number.

FAQ

- What if I can’t tax my car online? You can tax your car by phone or at a Post Office that deals with vehicle tax.

- How much is car tax? The cost of car tax depends on your car’s CO2 emissions and fuel type.

- How long does it take to tax a car online? The online process usually takes just a few minutes.

- What if my MOT is due soon? You can still tax your car online, but you’ll need to get a new MOT before the current one expires.

- What happens if I don’t tax my car? You could face a fine and your car could be clamped.

- Can I get a refund on my car tax? You can get a refund if you sell your car, take it off the road (SORN), or scrap it.

- What if I have a new car? You’ll need to tax your new car before you can drive it on the road.

Need Help with your car?

If you need assistance with any car detailing or diagnostic issues, please contact us via WhatsApp: +1(641)206-8880 or email us at [email protected]. Our customer support team is available 24/7 to assist you.

Leave a Reply