When securing car insurance, understanding what personal details insurance companies require is crucial. This article will delve into the specific information needed, why it’s necessary, and how it impacts your premium. We’ll equip you with the knowledge to navigate the insurance process confidently and ensure a smooth experience.

Why Do Car Insurance Companies Need My Information?

Insurance companies use your personal details to assess risk and calculate your premium. The more information they have, the more accurately they can determine the likelihood of you making a claim. This process allows them to offer you a fair and appropriate price for your coverage.

What Personal Details Are Required for Car Insurance?

Several key pieces of information are universally required by car insurance providers. These details fall into a few main categories:

- Personal Identification: Your full name, date of birth, and address are essential for identification and verifying your driving history. They also need your contact information, including email and phone number, to communicate effectively with you.

- Driving History: This includes your driver’s license number, date of issue, and any endorsements or restrictions. Details about past accidents, traffic violations, and claims are also crucial. Insurers use this information to assess your driving habits and predict future risk.

- Vehicle Information: The make, model, year, and Vehicle Identification Number (VIN) of your car are needed to determine the value and safety features of the vehicle. This data influences the cost of coverage, as some cars are more expensive to repair or replace than others.

- Usage and Coverage Details: How you intend to use the vehicle (e.g., commuting, personal use) and the level of coverage you desire (e.g., liability only, comprehensive) affect your premium. Information about other drivers who will be using the car is also often required.

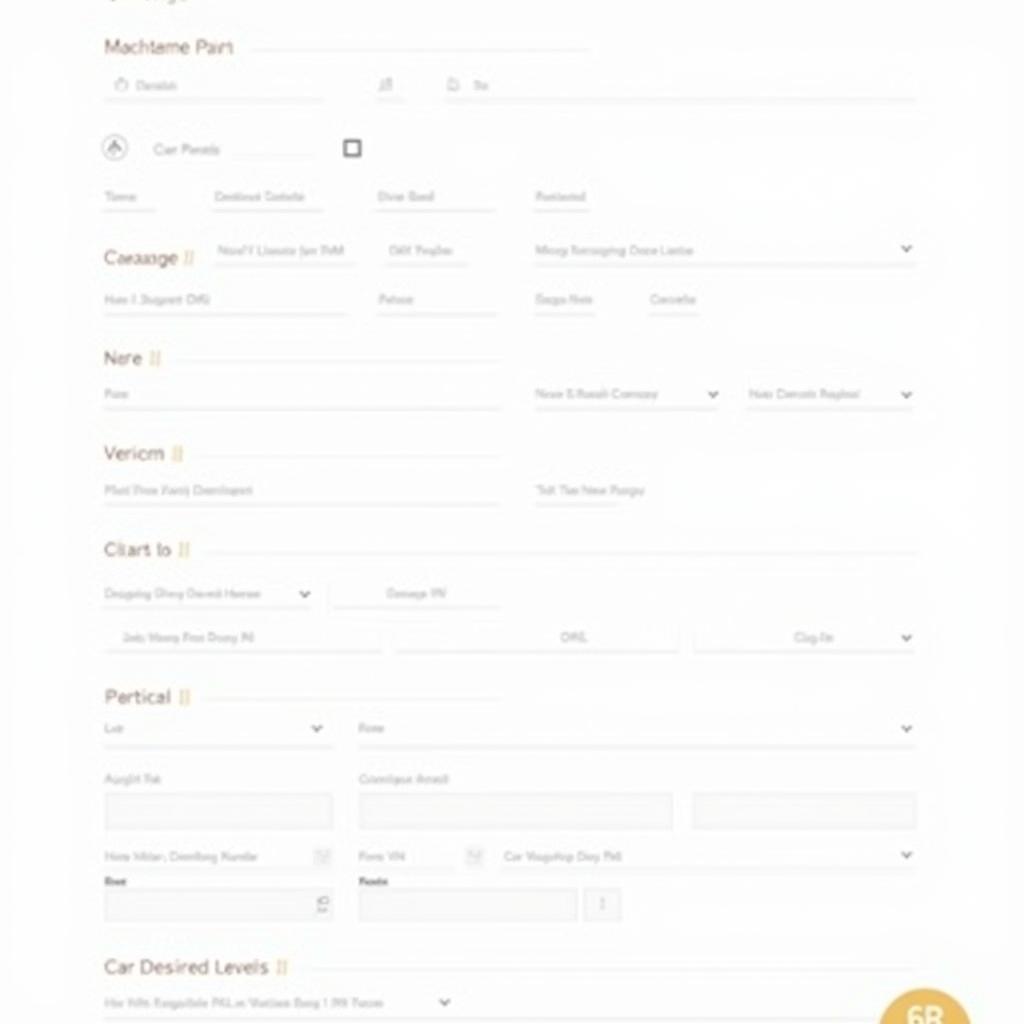

Car Insurance Application Form

Car Insurance Application Form

How Does This Information Affect My Premium?

Your provided information directly impacts your insurance premium. For example, a younger driver with a history of speeding tickets will likely pay more than an older driver with a clean record. Similarly, a sports car is typically more expensive to insure than a family sedan.

What About My Credit Score?

In some regions, car insurance companies may also consider your credit score. Studies have shown a correlation between credit scores and insurance claims. A lower credit score might suggest a higher risk, potentially leading to a higher premium.

Ensuring Accuracy and Transparency

Providing accurate and complete information is essential. Misrepresenting information can invalidate your policy or lead to claim denial. Always double-check your details and be upfront with your insurer about any potential risks.

What if My Circumstances Change?

It’s crucial to inform your insurance company of any significant changes in your circumstances, such as a new address, a change in vehicle usage, or adding another driver to your policy. Keeping your information up-to-date ensures your coverage remains accurate and valid.

Updating Car Insurance Information

Updating Car Insurance Information

Conclusion

Understanding what personal details car insurance companies need empowers you to navigate the insurance process effectively. By providing accurate and complete information, you ensure a fair premium and avoid potential issues with your coverage. Remember to keep your insurer updated on any changes in your circumstances to maintain accurate and valid protection.

FAQ

- What if I don’t have a driver’s license? You will likely not be able to obtain car insurance without a valid driver’s license.

- Can I insure a car that isn’t registered in my name? While possible, it’s often more complicated and may require additional documentation.

- How often should I review my car insurance policy? It’s recommended to review your policy annually or whenever there is a significant change in your circumstances.

- What if I disagree with the information the insurance company has about me? You have the right to dispute inaccurate information and provide supporting documentation to correct it.

- How can I find the best car insurance rates? Comparing quotes from multiple insurers is the best way to find the most competitive rates.

- Do I need to provide my social security number? Some insurers may request it, but it’s not always mandatory.

- What happens if I provide false information? Your policy could be invalidated, and any claims may be denied.

Need further assistance? Contact us via WhatsApp: +1(641)206-8880, Email: [email protected]. We have a 24/7 customer service team.

Leave a Reply