Taxing your car in the UK is a legal requirement, and knowing exactly what you need can save you time and potential fines. This guide will walk you through the essential details required to tax your car smoothly and efficiently, whether online, by phone, or at the post office.

Essential Documents and Information for Car Tax

Understanding the required documentation is crucial for a hassle-free taxing process. Gathering these beforehand streamlines the process, whether you’re taxing a new or used vehicle.

- V5C Registration Certificate (Logbook): This document proves you own the vehicle and contains vital information needed for taxing. Make sure you have the most up-to-date version.

- Insurance Details: Valid car insurance is a legal requirement before taxing. You’ll need your insurance policy number and details. You can find more information in our article, [do i need insurance details to tax my car](https://cardetailinguk.com/do-i need-insurance-details-to-tax-my-car/).

- MOT Certificate (if applicable): For vehicles over three years old, a valid MOT certificate is mandatory for taxation.

- Payment Details: Have your debit or credit card ready for online or phone payments. At the post office, you can pay by cash, cheque, or postal order.

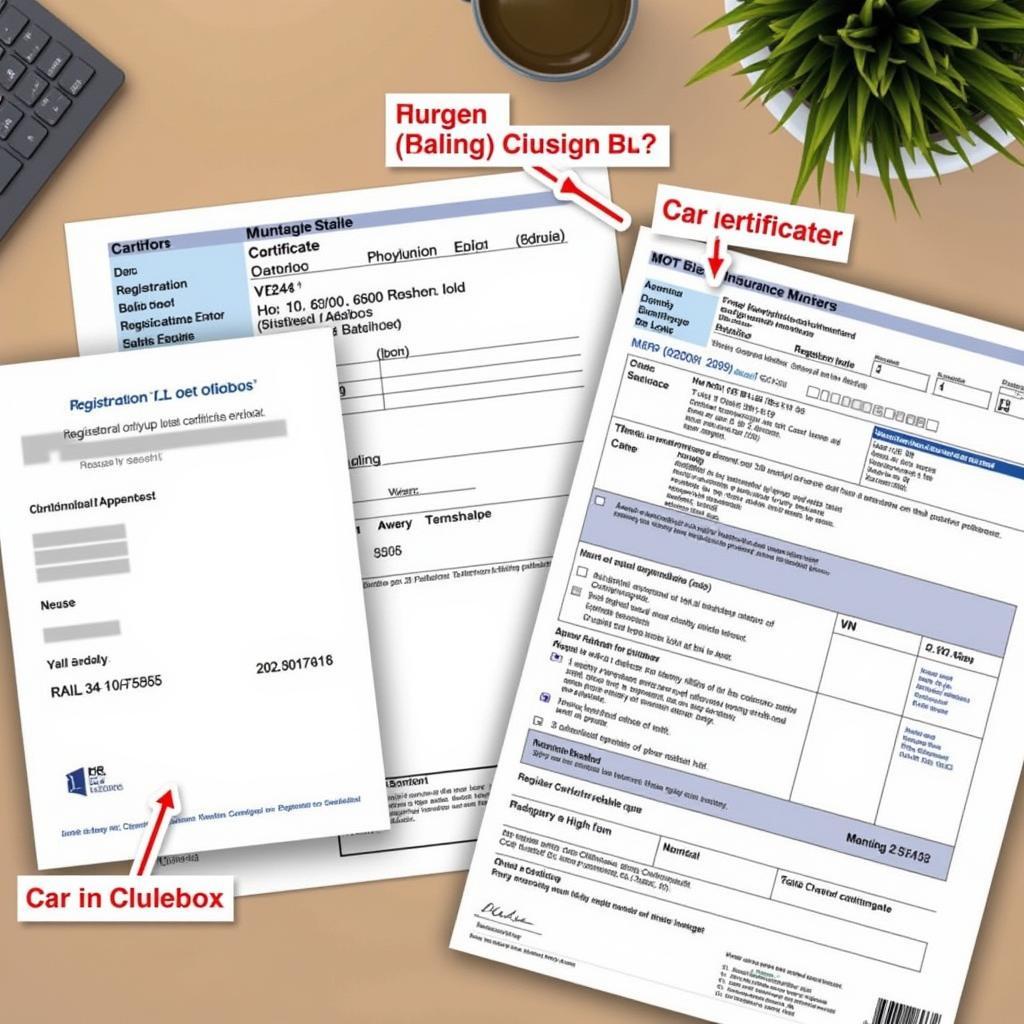

Car Tax Documents: V5C, Insurance, and MOT

Car Tax Documents: V5C, Insurance, and MOT

Taxing Your Car: Online, Phone, or Post Office

There are three main ways to tax your car: online, by phone, or at a post office. Each method has its own set of requirements and benefits.

Taxing Your Car Online

Taxing online is the quickest and most convenient method. You’ll need your V5C registration certificate (logbook) reference number and the 11-digit reference number from your renewal reminder (V11). For more details on taxing online, check out our article what details do you need to tax your car online.

Taxing Your Car by Phone

You can tax your car by phone if you have a new vehicle or a SORN (Statutory Off Road Notification). You’ll need the 11-digit reference number from your V5C or new keeper supplement (V5C/2).

Taxing Your Car at the Post Office

If you prefer face-to-face interaction, you can tax your car at any Post Office branch that deals with vehicle licensing. You’ll need your V5C and other relevant documents, along with your chosen payment method.

What Details Do I Need to Tax a Car if I’ve Lost My V5C?

Losing your V5C can complicate the process. You’ll need to apply for a replacement V5C from the DVLA before you can tax your car. Explore our guide on how to get car details by number for more information on retrieving your car details. Similarly, understanding what details do you need to tax your car is vital.

Frequently Asked Questions (FAQ)

- What if my MOT is due soon? You must have a valid MOT before taxing your car.

- Can I tax my car for six months? Yes, you can choose to pay for six months or a year.

- What if my car is exempt from tax? You still need to declare it as exempt with the DVLA.

- Do I need to display a tax disc? No, tax discs are no longer required to be displayed.

- What happens if I tax my car late? You could face a fine.

Conclusion

Taxing your car is a straightforward process once you have the correct details. By following this guide, you can ensure you have everything you need to tax your car smoothly and avoid any unnecessary delays or penalties. Remember to double-check your documentation and choose the most convenient method for your needs. For assistance, contact us via WhatsApp: +1(641)206-8880, or email: [email protected]. Our customer service team is available 24/7.

Leave a Reply