Knowing How To Check Car Tax Details is crucial for both buyers and sellers in the UK. It ensures legal compliance and protects against potential issues down the line. This guide will walk you through the process, providing you with the information you need to navigate the system effectively.

Why Checking Car Tax Details is Important

Confirming a vehicle’s tax status is essential for various reasons. For buyers, it avoids inheriting any outstanding tax liabilities. For sellers, it streamlines the sales process and ensures a smooth transaction. Unpaid car tax can lead to fines and legal complications, so confirming its status offers peace of mind. Furthermore, verifying the tax details can reveal potential discrepancies in the vehicle’s history, which can be a red flag for buyers. It also allows you to budget accurately for future tax payments.

How to Check Car Tax Details Online

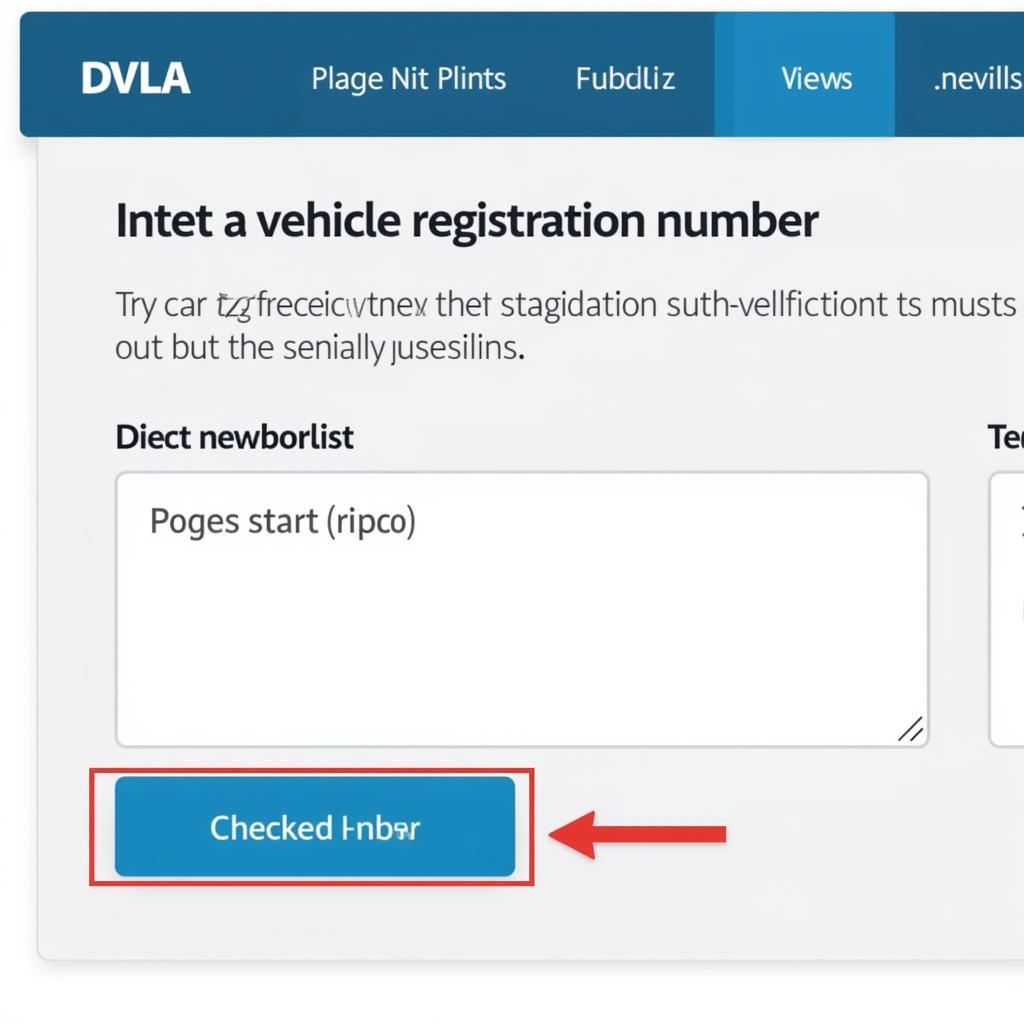

The easiest way to check car tax details is through the Driver and Vehicle Licensing Agency (DVLA) website. You’ll need the vehicle’s registration number. Simply enter the details on the DVLA’s vehicle enquiry service, and the website will display the vehicle’s tax status, including the expiry date and the rate paid. This online service is available 24/7, providing quick and convenient access to vital information.

Using the DVLA Website for Vehicle Enquiries

The DVLA website offers a user-friendly interface for checking vehicle tax details. Once you’ve entered the registration number, you’ll receive detailed information about the vehicle’s tax status. The website confirms whether the vehicle is currently taxed, the date the tax expires, and the amount paid. You can also check the vehicle’s SORN (Statutory Off Road Notification) status, indicating whether it’s legally declared as off the road and exempt from tax.

Checking car tax online via DVLA website

Checking car tax online via DVLA website

Other Ways to Check Car Tax Details

While the DVLA website is the most convenient method, there are other ways to check car tax details. You can contact the DVLA by phone, although this might involve longer waiting times. Alternatively, if you’re purchasing a vehicle, you can ask the seller to provide proof of valid car tax. This could be in the form of a physical tax disc (for older vehicles) or a recent online tax confirmation.

Contacting the DVLA by Phone

If you prefer to speak to someone directly, you can call the DVLA for information about car tax. Be prepared to provide the vehicle’s registration number and potentially other identifying details. While this method can be helpful for complex situations, it’s generally slower than the online service.

DVLA customer service representative answering car tax query

DVLA customer service representative answering car tax query

What if the Car Tax is Expired?

If you discover that the car tax is expired, you must take action immediately. You’ll need to tax the vehicle online through the DVLA website or at a Post Office that offers vehicle licensing services. Driving a vehicle without valid tax is illegal and can result in significant penalties. You might also need to ensure the car has a valid MOT certificate before taxing it. For further information regarding changing payment details, you can refer to our article on how to change bank details for car tax.

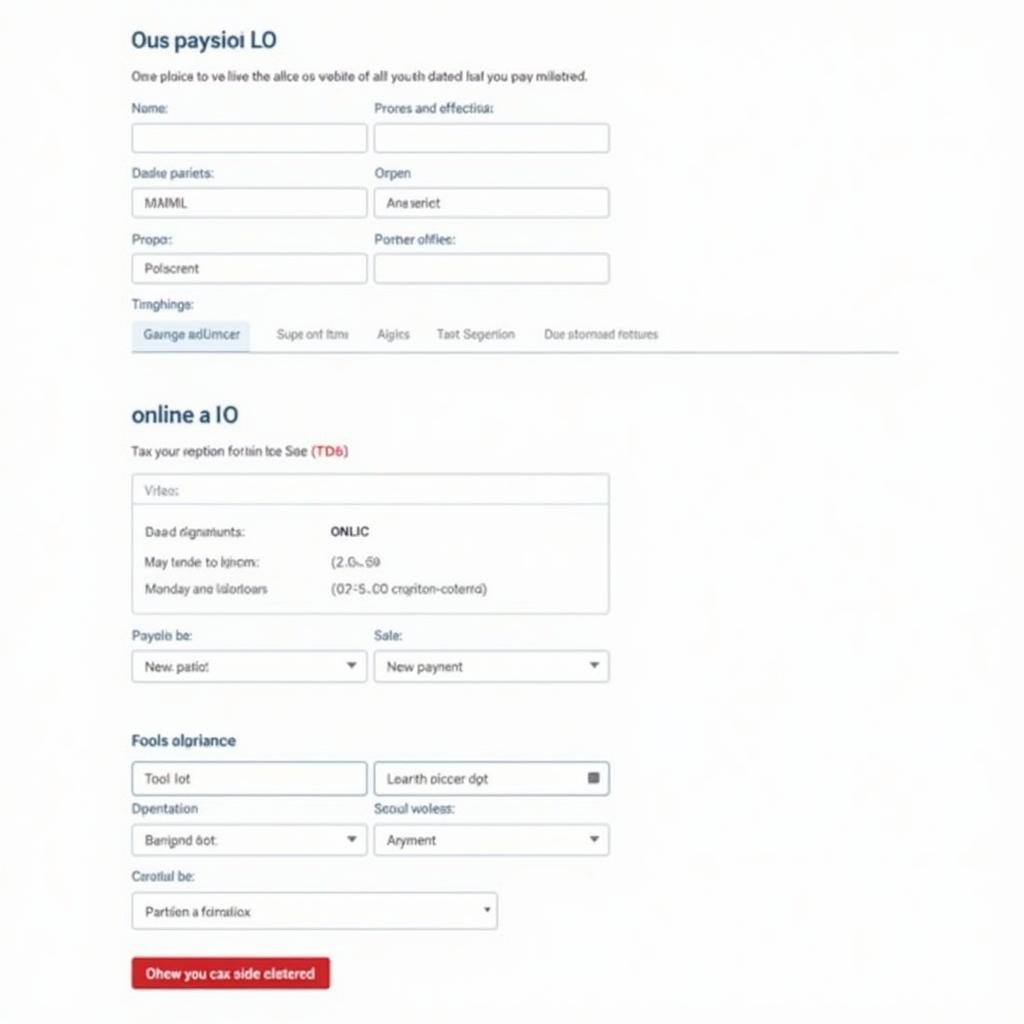

Taxing a Vehicle with Expired Tax

The process for taxing a vehicle with expired tax is similar to taxing a newly purchased vehicle. You’ll need to provide the vehicle’s registration number, V5C logbook details, and insurance information. The DVLA website provides a step-by-step guide to complete the process online. Similar to finding tax details, you can learn how to get car details by registration number.

Taxing a car online through the DVLA website

Taxing a car online through the DVLA website

Conclusion

Checking car tax details is a simple yet vital step for both buying and selling vehicles. The DVLA website offers a quick and efficient method to access this information, ensuring a smooth and legal transaction. By taking the time to verify the car tax details, you can avoid potential problems and maintain peace of mind. If you are considering starting a detailing business, our article is starting a car detailing business worth it? might be helpful. It’s always better to be informed and prepared when dealing with vehicle ownership. And, you may want to read our article about how to check car owner details.

FAQs

- What do I need to check car tax details online? You need the vehicle’s registration number.

- Is it illegal to drive without valid car tax? Yes, it is illegal and can result in fines.

- Where can I tax my vehicle? Online via the DVLA website or at a Post Office offering vehicle licensing services.

- What is a SORN? A Statutory Off Road Notification declaring a vehicle as off the road and exempt from tax.

- What if the car tax is expired? You must tax the vehicle immediately to avoid penalties.

- How can I check if a vehicle has a valid MOT? You can check this on the GOV.UK website.

- What documents do I need to tax a vehicle? You’ll need the V5C logbook, insurance details, and the vehicle’s registration number.

Do you tip for car detailing? Learn more in our dedicated article.

Need help with car detailing? Contact us on WhatsApp: +1(641)206-8880 or Email: [email protected]. Our 24/7 customer service team is always ready to assist you.

Leave a Reply