Running a successful car detailing business involves more than just providing sparkling clean vehicles. Understanding your tax obligations is crucial. One common question among detailers, especially those just starting out, is “does a car detail business need to charge state tax?” Let’s delve into this important topic.

Knowing whether you need to collect and remit sales tax is essential for legal compliance and financial stability. how to get car detailing license Ignoring these regulations can lead to hefty penalties and damage your business reputation. The rules vary significantly depending on your location. Some states exempt services like car detailing while others consider it taxable.

Navigating State Sales Tax Laws for Car Detailing

Each state has its own set of regulations regarding sales tax. Some states have a straightforward sales tax system, while others have complex rules with varying rates and exemptions. The best way to determine your specific obligations is to consult your state’s Department of Revenue website or speak with a tax professional.

Understanding Nexus

A key concept to understand is “nexus.” This term refers to the connection between a business and a state that requires the business to collect sales tax. Physical presence, such as a brick-and-mortar store, typically establishes nexus. However, online sales and significant economic activity within a state can also create nexus, even if you don’t have a physical location there.

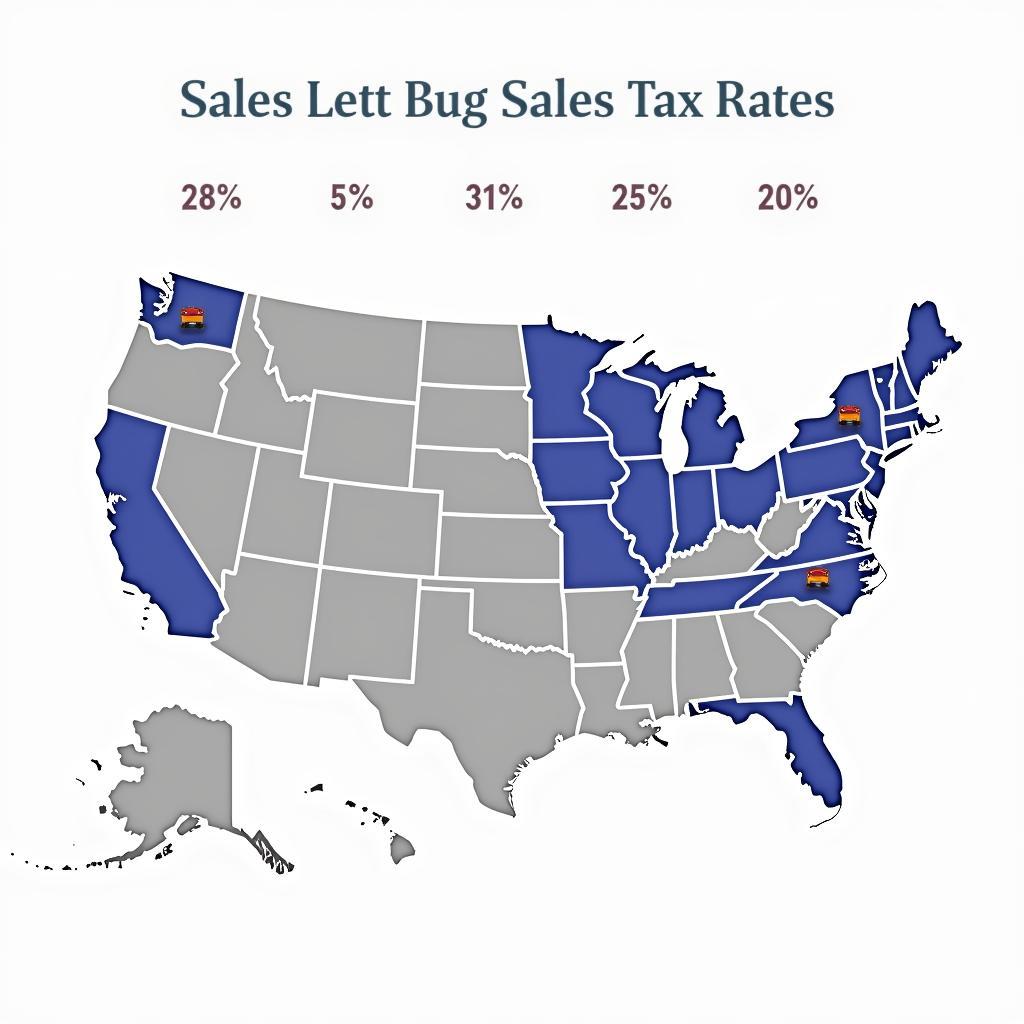

US State Sales Tax Map by State

US State Sales Tax Map by State

Car Detailing as a Taxable Service

Several states consider car detailing a taxable service. This means you must collect sales tax from your customers and remit it to the state. The rate varies, so checking your state’s specific regulations is important. Failure to collect and remit the proper amount of sales tax can result in penalties and interest charges.

Do You Need to Charge Sales Tax for Car Detailing Products?

Another aspect to consider is whether you sell detailing products alongside your services. If so, you’ll likely need to collect sales tax on those products. Even if your services are exempt, the tangible goods you sell are generally subject to sales tax.

Exemptions and Special Considerations

Some states offer exemptions for specific types of services or businesses. For instance, some states may exempt services performed on vehicles used for business purposes. Researching your state’s specific regulations to determine if any exemptions apply to your car detailing business is crucial.

“Understanding your state’s sales tax laws is paramount for any car detailer. It not only keeps you legally compliant but also builds trust with your customers,” says Sarah Miller, CPA and automotive industry consultant.

Consequences of Non-Compliance

Failing to comply with state sales tax laws can have severe consequences. Penalties can include back taxes, interest, and even legal action. It’s always better to be proactive and understand your obligations from the outset.

Tax Audit and Penalties

Tax Audit and Penalties

“Don’t let tax issues derail your car detailing business. Invest time in understanding your obligations or consult a professional for guidance,” adds David Lee, a seasoned business attorney specializing in small businesses.

Conclusion: Stay Informed and Compliant

Determining whether your car detail business needs to charge state tax requires careful research and attention to your specific location and services offered. Staying informed about state sales tax laws is crucial for the long-term success and legal compliance of your car detailing business. Consulting with a tax professional is highly recommended to ensure you meet all legal requirements. By understanding and adhering to these regulations, you can focus on what you do best – providing top-notch detailing services to your clients.

FAQ

- What is nexus in relation to sales tax?

- How can I find out my state’s sales tax rate for car detailing services?

- Are there any exemptions for car detailing services in my state?

- What are the penalties for not collecting and remitting sales tax?

- Where can I find more information about sales tax regulations for my business?

- Do I need to charge sales tax if I only sell detailing products online?

- How often do I need to remit sales tax to the state?

Are there any other questions you have about how to get car detailing license?

For further information about starting and managing your car detailing business, please explore our other articles on our website.

Need support? Contact us via WhatsApp: +1(641)206-8880 or Email: [email protected]. Our customer support team is available 24/7.

Leave a Reply