Knowing how to check your car insurance policy details is crucial. Whether you’re renewing, making a claim, or simply verifying your coverage, accessing your policy information is essential. This article provides a comprehensive guide on how to access your car insurance details quickly and efficiently.

Accessing your car insurance policy details is easier than ever in today’s digital age. Various methods are available, offering convenience and quick access to vital information. From online portals to mobile apps, understanding these methods can empower you to manage your insurance efficiently. This knowledge is vital not just for claims but also for understanding your coverage and ensuring you’re adequately protected. Let’s explore the various ways you can check your car insurance policy details.

Different Ways to Access Your Car Insurance Policy Details

There are several ways to check your car insurance policy information. The best method for you depends on your insurer and your personal preferences.

- Insurer’s Website: Most insurance companies provide online portals where you can log in and view your policy documents. This usually requires creating an account and providing your policy number.

- Mobile App: Many insurers offer mobile apps, providing on-the-go access to your policy details. This can be a convenient option for quickly checking information or filing a claim.

- Email: You can often request your insurer to send you a copy of your policy documents via email.

- Phone: Calling your insurance company directly is always an option. A representative can guide you through accessing your policy details or answer any questions you may have.

- Mail: While less common in today’s digital world, you can request a physical copy of your policy documents to be mailed to you.

If you’re unsure about the specifics of your car’s coverage, checking your policy is a must. This also applies if you can’t remember details of a car accident. Understanding your policy details is essential for navigating such situations.

Understanding Your Car Insurance Policy Documents

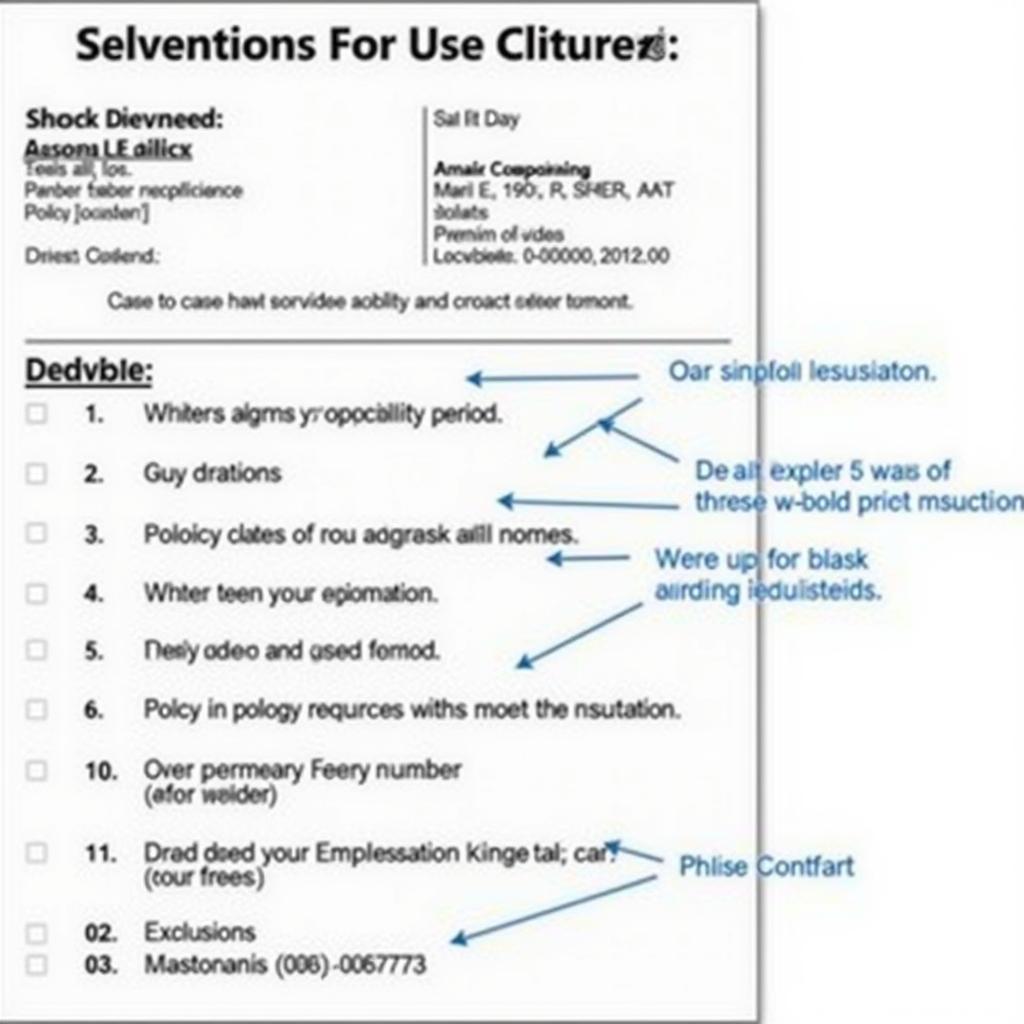

Once you access your policy documents, it’s important to understand the key information they contain. Look for:

- Policy Number: This unique identifier is essential for any communication with your insurer.

- Coverage Details: This outlines the types of coverage you have, such as liability, collision, and comprehensive. It also specifies the coverage limits for each type.

- Deductible: This is the amount you’ll have to pay out-of-pocket before your insurance coverage kicks in.

- Premium: This is the amount you pay for your insurance coverage, usually monthly or annually.

- Policy Period: This specifies the start and end dates of your coverage.

- Exclusions: This lists any situations or events that are not covered by your policy.

- Contact Information: This includes the contact details for your insurer and your agent.

Knowing how to find insurance details of a car is fundamental for any car owner. It’s essential to have quick access to this information in case of an accident or other unforeseen circumstances.

Key Information in Car Insurance Policy

Key Information in Car Insurance Policy

What If I Can’t Find My Car Insurance Policy Details?

If you can’t locate your car insurance policy details, don’t panic. Contact your insurance company directly. They can provide you with copies of your policy documents or help you access them online. Be prepared to provide information such as your name, address, and vehicle information. If you’re looking to equip yourself for detailing, finding out what to buy to detail your car is a good first step. Understanding your insurance coverage goes hand-in-hand with car maintenance.

Consider tipping your detailer for a job well done. You might wonder is it necessary to tip someone for detailing my car? While not mandatory, it’s a gesture of appreciation for excellent service.

Tips for Managing Your Car Insurance Policy

- Keep your policy documents in a safe place: Whether digitally or physically, ensure you can access them easily.

- Review your policy regularly: Make sure your coverage still meets your needs and that your information is up-to-date.

- Contact your insurer with any changes: Inform them of any changes in your address, vehicle, or driving habits.

- Shop around for quotes when renewing: Comparing quotes from different insurers can help you find the best deal.

- Understand how to check car details by its number, this is a useful skill for verifying vehicle information.

Conclusion

Knowing how to check your car insurance policy details is crucial for any car owner. By understanding the various methods available and the key information contained within your policy documents, you can effectively manage your insurance and ensure you’re adequately protected. Remember to keep your policy information secure and readily accessible for when you need it most.

FAQs

- What if I lose my car insurance policy documents?

- How can I update my car insurance policy information?

- Can I access my car insurance policy details online?

- What information do I need to provide to access my policy details?

- How often should I review my car insurance policy?

- What should I do if I can’t remember my car insurance policy number?

- Can I get a copy of my car insurance policy by email?

Situations where checking your insurance policy is crucial:

- After an accident: To understand your coverage and claim process.

- When renewing your policy: To compare coverage and prices.

- When selling or buying a car: To ensure proper transfer of insurance.

- If you receive a traffic ticket: To understand potential impacts on your premium.

Further Exploration:

For more related information, you can check out these articles: How to find insurance details of a car and Can’t remember details of car accident. These resources can provide valuable insights into related topics.

Need assistance? Reach out to us via WhatsApp: +1(641)206-8880 or Email: [email protected]. Our 24/7 customer support team is always ready to help.

Leave a Reply